Types of Life Insurance Policies

Term Insurance

Have you recently acquired a new home or asset? Do you have children that will head to college soon? With term insurance, you can protect your family from the potential burden of loans.

Whole Life Insurance

Getting older? If you want to cover final expenses and leave wealth for your loved ones, whole life insurance is a good choice with its accumulating cash values.

Universal Insurance

Are you seeking coverage similar to whole life insurance, yet with more flexibility? Universal life insurance may be the right fit for you.

Why Buy Life Insurance?

If you're shopping for life insurance, you're making an important financial step. A life insurance payout can come to your family's rescue if you're suddenly no longer around. The money can help your family stay in their house, pay daily expenses, fund college or help with any other financial need.

Like any other purchase, you also want to get a good deal.

The best way to save money is to comparison shop and get life insurance quotes from multiple companies. That's because rates vary among companies.

How To Decide What Type of Life Insurance You Need

The first step in shopping for life insurance quotes is usually deciding what type of policy you want (such as term life or whole life).

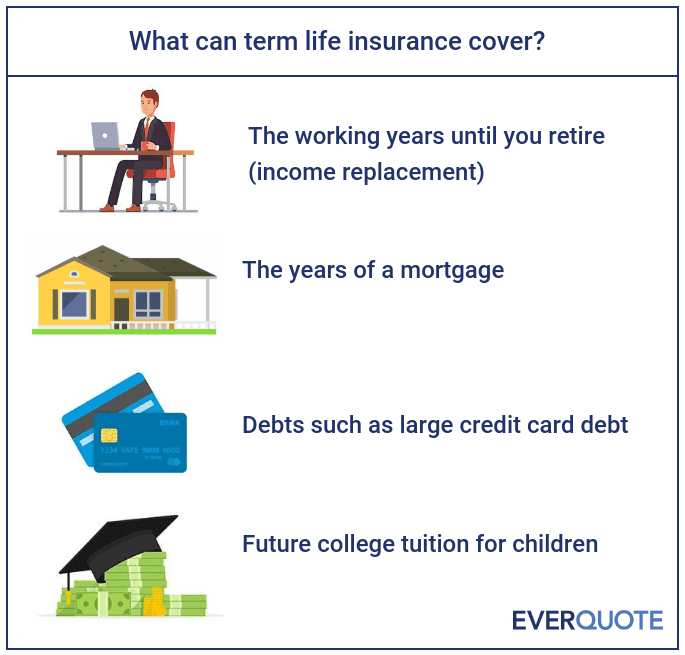

Term life insurance is purchased for a specific time period, such as 5, 10, 20 or 30 years. It's good for people who have a specific financial obligation to cover, such as the years of a mortgage or the years until children graduate from college.

Whole life insurance can provide a payout no matter when you die. It's good for people whose family will always need financial support.

Universal life insurance sometimes offers the flexibility to vary premiums and the death benefit. Coverage generally lasts until a certain age, such as 100.

| Term Life Insurance | Universal Life Insurance | Whole Life Insurance | |

|---|---|---|---|

| Length of policy | Set period of time such as 5, 10, 20 or 30 years | Usually to a certain age, such as 100 | Lifetime |

| Relative Cost | $ | $$ | $$$ |

| Premiums | Fixed | Flexible (with some types) | Fixed |

| Builds cash value? | No | Yes (with some types) | Yes |

How Much Is Life Insurance?

Term life insurance is generally the cheapest way to buy life insurance because it lasts only for a fixed period and does not build cash value. (That means you can't withdraw money from the policy, like you can with whole life insurance.)

Let's say you're 30 years old, healthy, and looking for a $500,000 term life policy for 20 years. The average cost is about $300 a year for a male and about $260 for a female.

Average Life Insurance Rates For a $500,000 Term Life Insurance Policy

| Sex and Age | 10-year $500,000 policy | 20-year $500,000 policy | 30-year $500,000 policy |

|---|---|---|---|

| Male age 30 | $235 | $308 | $406 |

| Male age 40 | $295 | $380 | $652 |

| Male age 50 | $509 | $879 | $1,541 |

| Female age 30 | $220 | $271 | $359 |

| Female age 40 | $272 | $341 | $551 |

| Female age 50 | $447 | $694 | $1,200 |

| Methodology: We averaged the three cheapest rates we found online for term life. Rates are for men and women of average height and weight, non-smoking, with normal blood pressure, in excellent health, with no DUIs or tickets on their driving records. Your own rates will be different. | |||

See more average life insurance rates.

How Much More Will It Cost You?

| Factor | Increase in life insurance quotes | |

|---|---|---|

| Using marijuana more than 2 times a month | 162% | |

| High blood pressure | 185% | |

| Using nicotine replacements such as patches, gum or e-cigarettes | 204% | |

| Smoking a cigar more than once a month | 234% | |

| Smoking cigarettes more than 2 times a month | 317% | |

| Methodology: We averaged quote increases for 20-year term life insurance policies for $500,000, $1 million and $2 million in coverage. Rates were for men and women of average height and weight in excellent health. For high blood pressure we used a reading of 141/91. | ||

Read more about these topics:

- Life insurance for smokers

- The best life insurance for cigar smokers

- Life insurance for marijuana users

- What do life insurance companies look for on a driving record?

- Can you buy life insurance after cancer?

- Foreign travel can affect life insurance buyers

Choosing a Life Insurance Company

There are many life insurance companies competing for your business. See our list of life insurance companies, or read our life insurance company reviews below.

See the largest life insurance companies in your state: |

How To Get Life Insurance Quotes

All life insurance quotes will be free and you can request quotes from as many companies as you like. You can get quotes from agents who work for specific companies, or use an independent agent to shop prices among multiple insurers.

EverQuote can connect you to agents who can give you prices and personalized service by answering any questions you have.

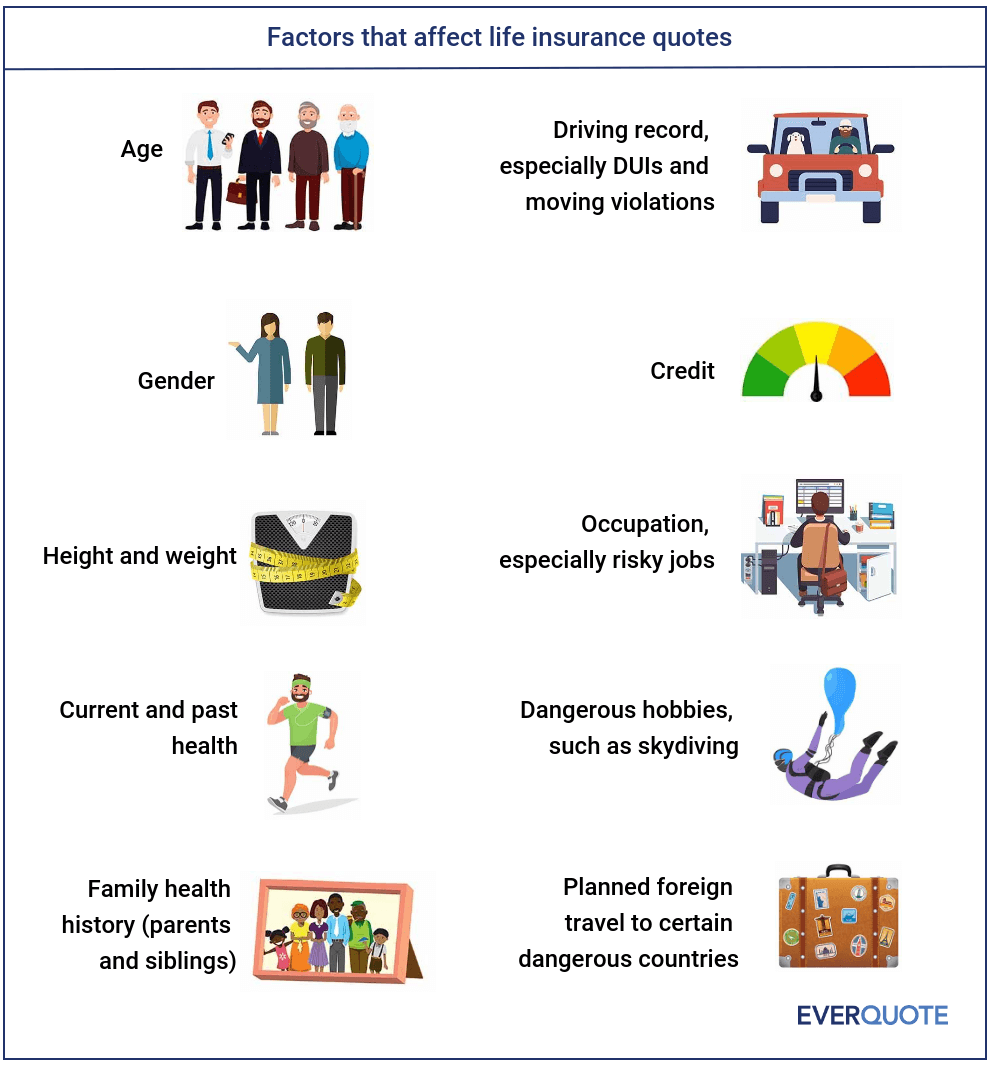

When you're getting a life insurance quote, the agent will ask you a variety of questions. The goal is to give you the most accurate quote possible based on your answers, so it's best to give the right information.

Expect to answer questions about your current health, the health of immediate family such as parents and siblings, the prescription medicines you've taken, occupation, hobbies, driving record, whether you currently have life insurance and who your beneficiary will be.

What to Expect Next

Once you've gotten life insurance quotes and picked a company, it's good to know what to expect. The life insurance application process can take several weeks, depending on the policy type and company. But it's worth the wait in order to lock in life insurance.

When you've decided to submit an application, it will go into "underwriting." During this time, the life insurance company gathers information about you, confirms the answers you gave on the application, might request medical records from your doctor, and sets a final quote.

- Don't be surprised if your life insurance quote changes during this time, either up or down. The life insurer might discover something that changes the price. For example, it may see something in your medical records or driving record that you forgot to mention that changes the quote.

- Prepare for a life insurance medical exam. Many companies require that applicants take a life insurance medical exam. You can schedule it for your convenience and have the examiner come to your house. The exam typically includes taking your height and weight, getting your blood pressure, and taking blood and urine samples. The examiner will also typically verify your answers to the application questions.

When the insurer has assessed all the data about you, it will give you a final life insurance quote. If you're happy with it, you'll accept the policy and know your family has a good financial safety net.